Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

Filed by the Registrantýx |

|

Filed by a Party other than the Registranto |

|

Check the appropriate box: |

ýo |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ox |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

|

Fidelity National Financial, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ýx |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) |

| (2) | Aggregate number of securities to which transaction applies:

|

| | (3) |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) |

| (4) | Proposed maximum aggregate value of transaction:

|

| | (5) |

| (5) | Total fee paid:

|

o |

|

|

o | Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

(1) |

|

Amount Previously Paid:

|

| | (2) |

| (2) | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| (3) | (4)Filing Party: |

| | |

| (4) | Date Filed:

|

| | |

| | | |

Table of Contents

Fidelity National Financial, Inc.

601 Riverside Avenue

Jacksonville, Florida 32204

May [ ], 2018

Dear Shareholder:

On behalf of the board of directors, I cordially invite you to attend the annual meeting of the shareholders of Fidelity National Financial, Inc. The meeting will be held on June 13, 2018 at 10:00 a.m., Eastern Time, in the Peninsular Auditorium at 601 Riverside Avenue, Jacksonville, Florida 32204. The formal Notice of Annual Meeting and Proxy Statement for this meeting are attached to this letter.

The Notice of Annual Meeting and Proxy Statement contain more information about the annual meeting, including:

•who can vote; and

•the different methods you can use to vote, including the telephone, Internet and traditional paper proxy card.

Whether or not you plan to attend the annual meeting, please vote by one of these outlined methods to ensure that your shares are represented and voted in accordance with your wishes.

On behalf of the board of directors, I thank you for your cooperation.

| | |

| |

|

|---|

| |

FIDELITY NATIONAL FINANCIAL, INC. 601 RIVERSIDE AVENUE JACKSONVILLE, FLORIDA 32204 APRIL 30, 2019 Dear Shareholder: On behalf of the board of directors, I cordially invite you to attend the annual meeting of the shareholders of Fidelity National Financial, Inc. The meeting will be held on June 12, 2019 at 10:00 a.m., Eastern Time, in the Peninsular Auditorium at 601 Riverside Avenue, Jacksonville, Florida 32204. The formal Notice of Annual Meeting and Proxy Statement for this meeting are attached to this letter. The Notice of Annual Meeting and Proxy Statement contain more information about the annual meeting, including: ·Who can vote; and ·The different methods you can use to vote, including the telephone, Internet and traditional paper proxy card. Whether or not you plan to attend the annual meeting, please vote by one of these outlined methods to ensure that your shares are represented and voted in accordance with your wishes. On behalf of the board of directors, I thank you for your cooperation. Sincerely, |

|

|

|

|

|

Raymond R. Quirk

Chief Executive Officer |

Table of Contents

Fidelity National Financial, Inc.

601 Riverside Avenue

Jacksonville, Florida 32204

NOTICE OF

ANNUAL

MEETING OF SHAREHOLDERS

To the Shareholders of Fidelity National Financial, Inc.:

Notice is hereby given that the 20182019 Annual Meeting of Shareholders of Fidelity National Financial, Inc. will be held on June 13, 201812, 2019 at 10:00 a.m., Eastern Time, in the Peninsular Auditorium at 601 Riverside Avenue, Jacksonville, Florida 32204 in order to:

1.electElect three Class III directors to serve until the 20212022 Annual Meeting of Shareholders or until their successors are duly elected and qualified or their earlier death, resignation or removal;

2.approveApprove a non-binding advisory resolution on the compensation paid to our named executive officers;

and

3.ratifyRatify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 20182019 fiscal year; and

4.approve our Fifth Amended and Restated Certificate of Incorporation to, among other things, remove provisions relating to the tracking stock structure.year.

At the meeting, we will also transact such other business as may properly come before the meeting or any adjournment thereof.

The board of directors set April 16, 201815, 2019 as the record date for the meeting. This means that owners of FNF GroupFNF’s common stock at the close of business on that date are entitled to:

•receive·Receive notice of the meeting; and

·

•voteVote at the meeting and any adjournments or postponements of the meeting.

As result of the Split-Off described below, no shares of FNFV Group common stock were outstanding as of the record date.

��

All shareholders are cordially invited to attend the annual meeting in person. However, even if you plan to attend the annual meeting in person,

please read these proxy materials and cast your vote on the matters that will be presented at the annual meeting. You may vote your shares through the Internet, by telephone, or by mailing the enclosed proxy card. Instructions for our registered shareholders are described under the question "How“How do I vote?"” on page 3 of the proxy statement.

| | |

Sincerely,

Michael L. Gravelle

Corporate Secretary | | Sincerely, |

|

|

|

| | Michael L. Gravelle

Corporate Secretary

|

Jacksonville, Florida

May [ ], 2018April 30, 2019

PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE (OR VOTE VIA TELEPHONE OR INTERNET) TO ASSURE REPRESENTATION OF YOUR SHARES.

|

Fidelity National Financial, Inc. |

|

|

Table of Contents

Fidelity National Financial, Inc.

601 Riverside Avenue

Jacksonville, Florida 32204

PROXY STATEMENT

The enclosed proxy is solicited by the board of directors, orthe board,of Fidelity National Financial, Inc., orFNForthe Company,for use at the Annual Meeting of Shareholders to be held on June 13, 201812, 2019 at 10:00 a.m., Eastern Time, or at any adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders. The annual meeting will be held in the Peninsular Auditorium at 601 Riverside Avenue, Jacksonville, Florida.

It is anticipated that such proxy, together with this proxy statement, will first be mailed on or about May[ ], 2018April 30, 2019 to all shareholders entitled to vote at the meeting.

The Company'sCompany’s principal executive offices are located at 601 Riverside Avenue, Jacksonville, Florida 32204, and its telephone number at that address is (904) 854-8100.

GENERAL INFORMATION ABOUT THE COMPANY

We are a leading provider of (i) title insurance, escrow and other title-related services, including trust activities, trustee sales guarantees, recordings and reconveyances and home warranty products and (ii) technology and transaction services to the real estate and mortgage industries. FNF is one of the nation'snation’s largest title insurance companycompanies operating through its title insurance underwriters—underwriters – Fidelity National Title Insurance Company, Chicago Title Insurance Company, Commonwealth Land Title Insurance Company, Alamo Title Insurance and National Title Insurance of New York Inc.— – which collectively issue more title insurance policies than any other title company in the United States. Through our subsidiary ServiceLink Holdings, LLC, orServiceLink,we provide mortgage transaction services, including title-related services and facilitation of production and management of mortgage loans.

We underwent significant change in 2017.

•Recent Transactions

On September 29, 2017, we completed our tax-free distribution to our FNF Group shareholders of all 83.3 million shares of New BKH Corp., orNew BKH,common stock that we previously owned, which we refer to as theSpin-OffSpin-Off. . Immediately following the Spin-Off, New BKH and our majority-owned subsidiary Black Knight Financial Services, Inc., orBKFS,engaged in a series of transactions resulting in the formation of a new publicly-traded holding company, Black Knight, Inc., orBlack Knight,which owns all of the outstanding shares of BKFS. In the Spin-Off, holders of FNF Group common stock received approximately 0.30663 shares of Black Knight common stock for each share of FNF Group common stock held at the close of business on September 20, 2017. Black Knight'sKnight’s common stock is listed under the symbol "BKI"“BKI” on the New York Stock Exchange. The BK Distribution is expected to generally be tax-free to FNF Group shareholders for U.S. federal income tax purposes, except to the extent of any cash received in lieu of New Black Knight's fractional shares.

Table of Contents

•On November 17, 2017 we completed our previously announcedthe split-off, which we refer to as theSplit-Off,of our former wholly-owned subsidiary Cannae Holdings, Inc., orCannae,which consists of the businesses, assets and liabilities formerly attributed to our FNF Ventures Group, orFNFV Group,including Ceridian Holding, LLC, American Blue Ribbon Holdings, LLC and T-System Holding LLC. The Split-Off was

|

1 | Fidelity National Financial, Inc. |

|

|

Table of Contents

accomplished by our redemption of all of the outstanding shares of our FNFV Group common stock for outstanding shares of common stock of Cannae on a one-for-one basis. As a result of the Split-Off, Cannae is a separate, publicly tradedpublicly-traded company whose stock is listed under the symbol "CNNE"“CNNE” on the New York Stock Exchange.

As a result of these transactions, FNF is now a more streamlined company with a pure focus within the title and real estate space. We expect to continue to focus on growing our business organically and through strategic acquisitions.

Stewart Merger

On March 19, 2018, we announced that we and certain of our wholly-owned subsidiaries had entered into an Agreement and Plan of Merger, or theMerger Agreement,with Stewart Information Services Corporation, orStewartStewart. . Upon the terms and subject to the conditions set forth in the Merger Agreement, we expect to acquire Stewart for $50.00 per share of common stock, subject to potential adjustment as described below, representing an equity value of approximately $1.2 billion. The consideration will be paid 50% in cash and 50% in FNF common stock. Stewart stockholders will also have the option to elect to receive their consideration in all cash or all stock, subject to pro ratapro-rata reductions to the extent the cash or stock option is oversubscribed. The FNF common stock component will be subject to a fixed exchange ratio that is based on FNF'sFNF’s volume weighted average price for the twenty trading days prior to the signing of the merger agreement. For those Stewart stockholders who elect to receive all FNF stock, the exchange ratio will be equal to 1.2850, subject to potential adjustment as described below and proration to the extent the stock option is oversubscribed. We refer to the transactions contemplated by the Merger Agreement as theStewart Merger. Under the terms of the Merger Agreement, if the combined company is required to divest assets or businesses for which 2017 annual revenues exceed $75 million, up to a cap of $225 million, in order to receive required regulatory approvals, the purchase price will be adjusted down on a pro-rata basis to a minimum purchase price of $45.50 per share of Stewart’s common stock. If the Stewart Merger is not completed for failure to obtain the required regulatory approvals, we would be required to pay a reverse break-up fee of $50 million to Stewart. A majority of Stewart’s shareholders voted to approve the Merger on Septeber 5, 2018. On March 11, 2019, we exercised our first option to extend the date upon which the Merger Agreement may be terminated by us or Stewart to June 18, 2019. We continue to work through the regulatory process for the Stewart Merger..

The Stewart Merger isremains subject to a number of risks and uncertainties, including the risk that Stewart stockholders may not adopt the merger agreement; the risk that the necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated; risks that any of the closing conditions to the proposed merger may not be satisfied in a timely manner; the risk that the businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the acquisition will not be realized; and other risks detailed in the "Statement“Statement Regarding Forward-Looking Information," "Risk Factors"” “Risk Factors” and other sections of the Company'sCompany’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission.

|

Fidelity National Financial, Inc. | 2 |

|

|

Table of Contents

GENERAL INFORMATION ABOUT THEANNUAL MEETING

Your shares can be voted at the annual meeting only if you vote by proxy or if you are present and vote in person. Even if you expect to attend the annual meeting, please vote by proxy to assure that your shares will be represented.

Why didWHY DID I receive this proxy statement?RECEIVE THIS PROXY STATEMENT?

The board is soliciting your proxy to vote at the annual meeting because you were a holder of FNF Groupour common stock at the close of business on April 16, 2018,15, 2019, which we refer to as the record date, and therefore you are entitled to vote at the annual meeting. This proxy statement contains information about the matters to be voted on at the annual meeting, and the voting process, as well as information about the Company'sCompany’s directors and executive officers.

Table of Contents

Who is entitled to vote?

WHO IS ENTITLED TO VOTE?

All record holders of FNF Groupour common stock as of the close of business on April 16, 201815, 2019 are entitled to vote. As of the close of business on that day, 274,588,956274,856,177 shares of FNF Groupour common stock were issued and outstanding and eligible to vote. Each share is entitled to one vote on each matter presented at the annual meeting.

If you hold your shares of FNF Group sharescommon stock through a broker, bank or other nominee, you are considered a "beneficial“beneficial owner,"” and you will receive separate instructions from the nominee describing how to vote your shares. As the beneficial owner, you have the right to direct your nominee on how to vote your shares. Beneficial owners may also vote their shares in person at the annual meeting after first obtaining a legal proxy from their nominees by following the instructions provided by their nominees, and presenting the legal proxy to the election inspectors at the annual meeting.

What shares are covered by the proxy card?

WHAT SHARES ARE COVERED BY THE PROXY CARD?

The proxy card covers all shares of FNF Groupcommon stock held by you of record (i.e., shares registered in your name) and any shares of FNF Groupcommon stock held for your benefit in our 401(k) plan.

How doHOW DO I vote?VOTE?

You may vote using any of the following methods:

•·In person at the annual meeting. All shareholders may vote in person at the annual meeting by bringing the enclosed proxy card or proof of identification, but if you are a beneficial owner (as opposed to a record holder), you must obtain a legal proxy from your broker, bank or nominee and present it to the inspectors at the annual meeting with your ballot when you vote at the meeting; or

|

3 | Fidelity National Financial, Inc. |

|

|

Table of Contents

•·By proxy. There are three ways to vote by proxy:

·

•byBy mail, using the enclosed proxy card and return envelope;

·

•byBy telephone, using the telephone number printed on the proxy card and following the instructions on the proxy card; or

·

•byBy the Internet, using a unique password printed on your proxy card and following the instructions on the proxy card.

Even if you expect to attend the annual meeting, please vote by proxy to assure that your shares will be represented.

What does it mean to vote by proxy?

WHAT DOES IT MEAN TO VOTE BY PROXY?

It means that you give someone else the right to vote your shares in accordance with your instructions. In this case, we are asking you to give your proxy to our Chief Executive Officer, Corporate Secretary, Assistant Corporate Secretary, and each of them, who are sometimes referred to as the "proxy“proxy holders."” By giving your proxy to the proxy holders, you assure that your vote will be counted even if you are unable to attend the annual meeting. If you give your proxy but do not include specific instructions on how to vote on a particular proposal described in this proxy statement, the proxy holders will vote your shares in accordance with the recommendation of the board for such proposal.

On what amON WHAT AM I voting?VOTING?

You will be asked to consider four proposals at the annual meeting.

•·Proposal No. 1No.1 asks you to elect three Class III directors to serve until the 20212022 Annual Meeting of Shareholders.

·

•- Proposal No. 2 asks you to approve, on a non-binding advisory basis, the compensation paid to our named executive officers in

2017.

2018.Table of Contents·

•- Proposal No. 3 asks you to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the

20182019 fiscal year.

•Proposal No. 4 asks you to approve our Fifth Amended and Restated Certificate of Incorporation to, among other things, remove provisions relating to our tracking stock structure.

How does the Board recommend thatHOW DOES THE BOARD RECOMMEND THAT I vote on these proposals?VOTE ON THESE PROPOSALS?

The board recommends that you vote:

1."FOR" the electionvote “FOR” each of the three Class I director nominees to serve until the 2021 Annual Meeting of Shareholders;

2."FOR" the approval of the non-binding advisory resolution on the compensation paid to our named executive officers;

- Proposals 1 through 3.

FOR" the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2018 fiscal year; and

4."FOR" the approval of our Fifth Amended and Restated Certificate of Incorporation.

What happens if other matters are raised at the meeting?

WHAT HAPPENS IF OTHER MATTERS ARE RAISED AT THE MEETING?

Although we are not aware of any matters to be presented at the annual meeting other than those contained in the Notice of Annual Meeting, if other matters are properly raised at the annual meeting in accordance with the procedures specified in FNF'sFNF’s certificate of incorporation and bylaws, all proxies given to the proxy holders will be voted in accordance with their best judgment.

|

Fidelity National Financial, Inc. | 4 |

|

|

What if I submit a proxy and later change my mind?Table of Contents

WHAT IF I SUBMIT A PROXY AND LATER CHANGE MY MIND?

If you have submitted your proxy and later wish to revoke it, you may do so by doing one of the following: giving written notice to the Corporate Secretary prior to the annual meeting; submitting another proxy bearing a later date (in any of the permitted forms) prior to the annual meeting; or casting a ballot in person at the annual meeting.

Who will count the votes?

WHO WILL COUNT THE VOTES?

Broadridge Investor Communications Services will serve as proxy tabulator and count the votes, and the results will be certified by the inspector of election.

How many votes must each proposal receive to be adopted?

HOW MANY VOTES MUST EACH PROPOSAL RECEIVE TO BE ADOPTED?

The following votes must be received:

•·For Proposal No. 1No.1 regarding the election of directors, a majority of votes of the FNF Groupour common stock cast is required to elect a director. Abstentions and broker non-votes will have no effect.

·

•- For Proposal No. 2 regarding a non-binding advisory vote on the compensation paid to our named executive officers, the affirmative vote of a majority of the shares of

the FNF Groupour common stock present in person or represented by proxy and entitled to vote would be required for approval. Even though your vote is advisory and therefore will not be binding on the Company, the board will review the voting result and take it into consideration when making future decisions regarding the compensation paid to our named executive officers. Abstentions will have the effect of a vote against this proposal and broker non-votes will have no effect.

·

•- For Proposal No. 3 regarding the ratification of the appointment of Ernst & Young LLP, under Delaware law, the affirmative vote of a majority of the shares of

the FNF Groupour common stock present

Table of Contents

in person or represented by proxy and entitled to vote would be required for approval. Abstentions will have the effect of a vote against this proposal. Because this proposal is considered a "routine"“routine” matter under the rules of the New York Stock Exchange, nominees may vote in their discretion on this proposal on behalf of beneficial owners who have not furnished voting instructions.

•For Proposal No. 4 regarding the approval of our Fifth Amended and Restated Certificate of Incorporation, a majority of votes of the outstanding shares of FNF Group stock entitled to vote is required to approve the proposal to remove the tracking stock structure. Abstentions and broker non-votes will have the effect of a vote against this proposal.

What constitutes a quorum?

WHAT CONSTITUTES A QUORUM?

A quorum is present if a majority of the outstanding shares of the FNF Groupour common stock entitled to vote at the annual meeting are present in person or represented by proxy. Broker non-votes and abstentions will be counted for purposes of determining whether a quorum of each class is present.

|

5 | Fidelity National Financial, Inc. |

|

|

What are broker non-votes? If I do not vote, will my broker vote for me?Table of Contents

WHAT ARE BROKER NON-VOTES? IF I DO NOT VOTE, WILL MY BROKER VOTE FOR ME?

Broker non-votes occur when nominees, such as banks and brokers holding shares on behalf of beneficial owners, do not receive voting instructions from the beneficial owners at least ten days before the meeting. If that happens, the nominees may vote those shares only on matters deemed "routine"“routine” by the Securities and Exchange Commission and the rules promulgated by the New York Stock Exchange thereunder.

The Company believes that all the proposals to be voted on at the annual meeting, except for Proposal 3 regarding the appointment of Ernst & Young LLP as our independent registered public accounting firm, are not "routine"“routine” matters. On non-routine matters, such as Proposals No. 1,No.1 and 2, and 4, nominees cannot vote unless they receive voting instructions from beneficial owners. Please be sure to give specific voting instructions to your nominee so that your vote can be counted.

What effect does an abstention have?WHAT EFFECT DOES AN ABSTENTION HAVE?

With respect to Proposal 1, abstentions or directions to withhold authority will not be included in vote totals and will not affect the outcome of the vote. With respect to each of Proposals 2 3 and 4,3, abstentions will have the effect of a vote against suchthe proposals pursuant to our bylaws and Delaware law, which with repect to Proposals 2 and 3, require that the proposal receives the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote, and with respect to Proposal 4, require that the proposal receives the affirmative vote a majority of outstanding share entitled to vote.

Who pays the cost of soliciting proxies?WHO PAYS THE COST OF SOLICITING PROXIES?

We pay the cost of the solicitation of proxies, including preparing and mailing the Notice of Annual Meeting of Shareholders, this proxy statement and the proxy card. Following the mailing of this proxy statement, directors, officers and employees of the Company may solicit proxies by telephone, facsimile transmission or other personal contact. Such persons will receive no additional compensation for such services. Brokerage houses and other nominees, fiduciaries and custodians who are holders of record of shares of FNF Groupour common stock will be requested to forward proxy soliciting material to the beneficial owners of such shares and will be reimbursed by the Company for their charges and expenses in connection therewith at customary and reasonable rates. In addition, the Company has retained Georgeson Inc. to assist in the solicitation of proxies for an estimated fee of $9,500 plus reimbursement of expenses.

Table of Contents

What ifWHAT IF I share a household with another shareholder?SHARE A HOUSEHOLD WITH ANOTHER SHAREHOLDER?

We have adopted a procedure approved by the Securities and Exchange Commission, called "householding."“householding.” Under this procedure, FNF Group shareholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our Annual Report and Proxy Statement unless one or more of these shareholders notifies us that they wish to continue receiving individual copies. This procedure will reduce our printing costs and postage fees. Shareholders who participate in householding will continue to receive separate proxy cards. Also, householding will not in any way affect dividend check

|

Fidelity National Financial, Inc. | 6 |

|

|

Table of Contents

mailings. If you are a shareholder who resides in the same household with another shareholder, or if you hold more than one account registered in your name at the same address, and wish to receive a separate proxy statement and annual report or notice of internet availability of proxy materials for each account, please contact, Broadridge, toll free at 1-866-540-7095. You may also write to Broadridge, Householding Department, at 51 Mercedes Way, Edgewood, New York 11717. Beneficial shareholders can request information about householding from their banks, brokers or other holders of record. We hereby undertake to deliver promptly upon written or oral request, a separate copy of the Annual Report to Shareholders, or this Proxy Statement, as applicable, to a shareholder at a shared address to which a single copy of the document was delivered.

CORPORATE GOVERNANCE HIGHLIGHTS

Our board is focused on good governance practices, which promote the long-term interests of our shareholders and support accountability of our board of directors and management. Our board of directors has implemented the following measures to improve our overall governance practices. See "Corporate“Corporate Governance and Related Matters"Matters” for more detail on FNF'sFNF’s governance practices.

·Proxy access right adopted in response to support from shareholders

·

•Majority voting in uncontested director elections proposed by management and adopted in response to shareholder support

·

•Independent leadership of our board of directors by our strong Lead Independent Director

·

•Annual performance evaluations of the board of directors and committees

·

•Robust stock ownership guidelines for our executive officers and directors

·

•Clawback policy

·

•Shareholders may act by written consent

·

•Independent audit, compensation and corporate governance and nominating committees

·

•Shareholder engagement on compensation and governance issues

·

•No supermajority voting requirement for shareholders to act

CORPORATE GOVERNANCE AND RELATED MATTERS

Corporate Governance Guidelines

CORPORATE GOVERNANCE GUIDELINES

Our corporate governance guidelines provide, along with the charters of the committees of the board of directors, a framework for the functioning of the board of directors and its committees and to establish a common set of expectations as to how the board of directors should perform its functions. The Corporate Governance Guidelines address a number of areas including the size and composition of the board, board membership criteria and director qualifications (including consideration of all aspects of diversity when considering new director nominees, including

|

7 | Fidelity National Financial, Inc. |

|

|

Table of Contents

diversity of age, gender, nationality, race, ethnicity and sexual orientation), director responsibilities, board agenda, roles of the Chairman of the board of directors, the selectionChief Executive Officer and Lead Director, meetings of independent directors, the functioningcommittee responsibilities and assignments, board member access to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of the board of directors, the committees of the board of directors, the evaluationsenior management and compensation of directors and the expectations of directors, including ethics and conflicts of interest.management succession planning. These guidelines specifically provide that a majority of the members of the board

Table of Contents

of directors must be outside directors whom the board of directors has determined have no material relationship with us and whom otherwise meet the independence criteria established by the New York Stock Exchange. The board of directors reviews these guidelines and other aspects of our governance at least annually. The board reviewed our corporate governance guidelines in April 2018 and approved changes relating to the factors our board will consider in selecting nominees for director, including those relating to all aspects of diversity.February 2019 without significant change. A copy of our Corporate Governance Guidelines is available for review on the Investor Relations page of our website at www.fnf.com. Shareholders may also obtain a copy by writing to the Corporate Secretary at the address set forth under "Available Information" below.

Code of Ethics and Business Conduct

CODE OF ETHICS AND BUSINESS CONDUCT

Our board of directors has adopted a Code of Ethics for Senior Financial Officers, which is applicable to our Chief Executive Officer, our Chief Financial Officer and our Chief Accounting Officer, and a Code of Business Conduct and Ethics, which is applicable to all our directors, officers and employees. The purpose of these codes is to: (i) promote honest and ethical conduct, including the ethical handling of conflicts of interest; (ii) promote full, fair, accurate, timely and understandable disclosure; (iii) promote compliance with applicable laws and governmental rules and regulations; (iv) ensure the protection of our legitimate business interests, including corporate opportunities, assets and confidential information; and (v) deter wrongdoing. Our codes of ethics were adoptedare designed to reinvigorate and renewmaintain our commitment to our longstanding standards for ethical business practices. Our reputation for integrity is one of our most important assets and each of our employees and directors is expected to contribute to the care and preservation of that asset. Under our codes of ethics, an amendment to or a waiver or modification of any ethics policy applicable to our directors or executive officers must be disclosed to the extent required under Securities and Exchange Commission and/or New York Stock Exchange rules. We intend to disclose any such amendment or waiver by posting it on the Investor Relations page of our website at www.fnf.com.

Copies of our Code of Business Conduct and Ethics and our Code of Ethics for Senior Financial Officers are available for review on the Investor Relations page of our website at www.fnf.com. Shareholders may also obtain

CORPORATE RESPONSIBILITY

Community Engagement

We believe in the importance of volunteerism and philanthropy as ways of strengthening and engaging local communities. With over 1,400 offices nationwide, FNF is in a copyunique position to champion these efforts at the local level, fostering a deep connection between our Company, our employees and the surrounding communities. Throughout the years, the FNF family of companies have supported such national charitable organizations as United Way, the American Heart Association, The Folded Flag Foundation, Make-A-Wish Foundation, Habitat for Humanity, and The Leukemia & Lymphoma Society, among others. In times of crisis, FNF has setup donation campaigns to help those affected by fires, floods, and hurricanes, as well as those affected by national tragedies that have occurred in recent years.

|

Fidelity National Financial, Inc. | 8 |

|

|

Table of Contents

FNF makes the greatest impact in the cities and towns in which we operate at the level of our local operations. Employees gather school clothes and supplies, winter coats, shoes, and holiday gifts for many hometown charitable organizations that support families in need. Hundreds of hours of employee volunteer time are given locally to help clean up communities, raise funds and awareness for various healthcare philanthropic causes, and feed the hungry. FNF strives to make a difference in all of the communities we serve.

Diversity

FNF stands committed to our philosophy that all employees deserve an inclusive workplace, one where each employee feels heard and empowered, and we have many women in leadership roles throughout our organization. All employees must be given equal access to opportunities throughout our organization. We regard having an inclusive work environment and a variety of employee ideas, perspectives, and experiences as a key component of our success. The diversity of our employees allows us to connect to our customers in important ways and thus be able to offer them meaningful, customized products and services that resonate with their unique needs.

Our board leads by example in its commitment to diversity. In 2017, Heather H. Murren joined our board, and in 2018, our board codified its commitment to consider all aspects of diversity when selecting new director nominees, including candidates with a diversity of age, gender, nationality, race, ethnicity, and sexual orientation by integrating it into the director selection criteria in our Corporate Governance Guidelines.

Sustainability

FNF recognizes our duty to conduct our business in an environmentally responsible manner. From eliminating the use of water bottles in favor of filtered water dispensers to participating in recycling programs, all of our locations are helping make a difference in the fight to save our environment.

Other sustainability efforts include records management and the use and disposal of IT equipment. FNF partners with vendors that have a commitment to sustainability. Our Record Management Centers are undergoing a complete digitization effort to consolidate records facilities and reduce paper. Once paper records are securely destroyed in accordance with federal, state and industry regulations, our vendor disposes of the waste in an environmentally friendly manner. Information technology asset disposal (computers, monitors, servers, mobile devices, etc.) is managed by an e-Steward certified vendor and process. After safely removing any data from the IT asset, it is either reused to maximize its lifecycle or securely recycled. Our vendor safely manages the waste stream of these codesthe thousands of pounds of electronics retired by writingFNF and ServiceLink each year.

Our commitment does not stop at our organization alone. Our Digital Strategy Initiative is another way FNF is making a commitment to moving the title insurance industry as a whole in a more sustainable direction. This initiative seeks to drastically reduce the amount of paper used in the closing process by using customer-focused technology at every point possible in the real estate transaction.

Information Technology and Security and Risk Management

We are highly dependent on information technology networks and systems to securely process, transmit and store electronic information. Attacks on information technology systems continue to

|

9 | Fidelity National Financial, Inc. |

|

|

Table of Contents

grow in frequency, complexity and sophistication. Such attacks have become a point of focus for individuals, businesses and governmental entities. These attacks can create system disruptions, shutdowns or unauthorized disclosure of confidential information, including non-public personal information, consumer data and proprietary business information.

We remain focused on making strategic investments in information security to protect our clients and our information systems. This includes both capital expenditures and operating expenses on hardware, software, personnel and consulting services. We apply a comprehensive approach to the Corporate Secretarymitigation of identified security risks. We have established risk management policies, including those related to privacy, information security and cybersecurity, and we employ a broad and diversified set of risk monitoring and risk mitigation techniques.

Our board has a strong focus on cybersecurity. At each regular meeting of the audit committee of our board of directors, our Chief Risk Officer, Chief Compliance Officer, Chief Information Security Officer and Chief Internal Auditor provide reports relating to our cyber and data security practices, risk assessments, emerging issues and any security incidents. Our audit committee chairman reports on these discussions to our board of directors on a quarterly basis. In addition, Mr. Rood has attended third-party director education courses on cybersecurity and privacy issues and trends.

Our employees are one of our strongest assets in protecting our customers’ information and mitigating risk. We maintain comprehensive and tailored training programs that focus on applicable privacy, security, legal and regulatory requirements that provide ongoing enhancement of the security and risk culture at the address set forth under "Available Information" below.FNF. We continue to provide strong focus on all areas of cybersecurity including threat and vulnerability management, security monitoring, identity and access management, phishing awareness, risk oversight, third-party risk management, disaster recovery and continuity management.

The Board

THE BOARD

Our board is composed of Douglas K. Ammerman, Willie D. Davis, William P. Foley, II, Thomas M. Hagerty, Janet Kerr, Daniel D. (Ron) Lane, Richard N. Massey, Heather H. Murren, Raymond R. Quirk, John D. Rood, Peter O. Shea, Jr. and Cary H. Thompson, with Mr. Foley serving as non-executive Chairman of the Board. After discussion among Mr.Additionally, Willie D. Davis and the other directors, it was decided that Mr. Davis would not be nominated for re-election at the annual meeting. In order for the Board to continue to benefit from Mr. Davis' valuable insight and a diverse point of view, Mr. Davis has been appointed by the board to serveserves as Director Emeritus, for a three-year term beginning after our 2018 annual meeting of shareholders. As Director Emeritus, Mr. Davis will be invited toand may attend and participate in board meetings, but willdoes not vote on board matters and will receive an annual cash retainer of $40,000 and an annual equity retainer withhis attendance is not considered in determining whether a value of approximately $107,500, which are equal to1/2 of the cash and equity retainers received by our other directors, for his service. In determining that Mr. Davis should serve as Director Emeritus, Mr. Davis and the board considered that he still provides valuable insight and a diverse point of view during board deliberations.quorum is present.

Our board met five times in 2017.2018. All directors attended at least 75% of the meetings of the board and of the committees on which they served during 2017.2018. Our non-management directors also met periodically in executive sessions without management, and our Lead Director presides over these executive sessions. We do not, as a general matter, require our board members to attend our annual

Table of Contents

meeting of shareholders, although each of our directors is invited to attend our 20182019 annual meeting. During 2017,2018, one of our board members attended the annual meeting of shareholders.

|

Fidelity National Financial, Inc. | 10 |

|

|

Majority VotingTable of Contents

MAJORITY VOTING

In February 2017, in response to our shareholders' support of our proposal at our 2016 annual shareholders meeting concerning majority voting in uncontested director elections, our board of directors amended and restated our bylaws to implement a "majority voting" bylaw.

“majority voting” in uncontested director elections. Pursuant to Section 3.1 of our bylaws, each director shall beis elected by a majority of the votes cast with respect to the director at any meeting for the election of directors at which a quorum is present. However, if as of 10 days in advance of the date we file our proxy statement with the SEC the number of director nominees exceeds the number of directors to be elected in such election (a "contested election"“contested election”), the directors shall be elected by the vote ofa plurality of the votes cast.

In an uncontested election of directors, any incumbent director who does not receive a majority of the votes cast will promptly tender his resignation to the board of directors. The board will decide, after considering the recommendation of the corporate governance and nominating committee, whether to accept or reject the tendered resignation, or whether other action should be taken. The director nominee in question will not participate in the recommendation or decision making process. We will publicly disclose an explanation by the board of its decision within 90 days after we publish the election results. If the board determines to accept a director'sdirector’s resignation, or if a director nominee who is not an incumbent director is not elected, then the board, in its sole discretion, may fill any resulting vacancy in accordance with our bylaws.

Director IndependenceDIRECTOR INDEPENDENCE

All of our directors other than Mr. Quirk, who is our Chief Executive Officer, are non-employees. During the first quarter of 2018,2019, the board of directors determined that Douglas K. Ammerman, Willie D. Davis, Thomas M. Hagerty, Janet Kerr, Daniel D. Lane, Richard N. Massey, Heather H. Murren, John D. Rood, Peter O. Shea, Jr. and Cary H. Thompson are independent under the criteria established by the New York Stock Exchange and our Corporate Governance Guidelines. The board of directors also determined that Messrs. Massey, Lane and Thompson meet the additional independence standards of the New York Stock Exchange for compensation committee members.

In determining independence, the board considered all relationships that might bear on our directors'directors’ independence from FNF. The board of directors determined that William P. Foley, II is not independent because he was the Executive Chairman and an employee of FNF during 2015 andBlack Knight which, until the first eight daysSpin-Off on September 29, 2017, was a subsidiary of 2016;FNF; and Raymond R. Quirk is not independent because he is the Chief Executive Officer and an employee of FNF.

In considering the independence of Douglas K. Ammerman, Thomas M. Hagerty, Daniel D. Lane, Heather H. Murren, Richard N. Massey, John D. Rood and Cary H. Thompson, the board of directors considered the following factors:

•In 2017, Messrs.·Until April 2018, Mr. Hagerty, Mr. Massey, Mr. Rood and Mr. Thompson each served as directors of, and they continue to own equity interests in, our subsidiary ServiceLink. Mr. Hagerty, Mr. Massey and Mr. Rood each servedalso serve as directors of and own equity interests in our subsidiary ServiceLink and inshares of Black Knight, which was our subsidiary prior to the Spin-Off in September 2017. Mr. Thompson also served as a director

|

11 | Fidelity National Financial, Inc. |

|

|

Table of ServiceLink and owns equity interests in ServiceLink and Black Knight.Contents

·

•Mr. Hagerty is a Managing Director of Thomas H. Lee Partners, L.P., which owns approximately 20.9% of the outstanding interests in ServiceLink.

·

•Messrs. Ammerman, Hagerty, Massey and Rood each own a small non-voting minority interest in Black Knight Sports and Entertainment LLC, which owns the Vegas Golden Knights.

Table of Contents

·Messrs. Ammerman, Hagerty and Massey each serve on the board of directors of The Dun & Bradstreet Corporation (D&B),a privately held company, and the general partner of Star Parent, L.P., the limited partnership that owns D&B. In addition, Messrs. Ammerman and Massey hold a small limited partnership interest in Star Parent, and affiliates of Thomas H. Lee Partners, L.P. owns a significant interest in Star Parent.

The board of directors determined that these relationships were not of a nature that would impair the independence of Mr. Ammerman, Mr. Hagerty, Ms. Murren, Mr. Massey, Mr. Rood or Mr. Thompson. Ms. Kerr,Mr. Lane and Mr. Shea had no relationships with the Company that required consideration in determining their independence.

Committees of the BoardCOMMITTEES OF THE BOARD

The board has three standing committees: an audit committee, a compensation committee and a corporate governance and nominating committee. The charter of each of the audit, compensation and corporate governance and nominatingstanding committee is available on the Investor Relations page of our website at www.fnf.com. Shareholders also may obtain a copy of any of these charters by writing to the Corporate Secretary at the address set forth under "Available Information"“Available Information” below.

Corporate Governance and Nominating CommitteeCORPORATE GOVERNANCE AND NOMINATING COMMITTEE

The members of the corporate governance and nominating committee are Peter O. Shea, Jr. (Chair) and Richard N. Massey. Each of Messrs. Shea and Massey was deemed to be independent by the board, as required by the New York Stock Exchange. The corporate governance and nominating committee met two timesacted by written consent but did not meet in 2017.2018.

|

Fidelity National Financial, Inc. | 12 |

|

|

Table of Contents

The primary functions of the corporate governance and nominating committee, as identified in its charter, are:

identifying·Identifying individuals qualified to become members of the board and making recommendations to the board regarding nominees for election;

·

•reviewingReviewing the independence of each director and making a recommendation to the board with respect to each director'sdirector’s independence;

·

•developingDeveloping and recommending to the board the corporate governance principles applicable to us and reviewing our corporate governance guidelines at least annually;

·

•makingMaking recommendations to the board with respect to the membership of the audit, compensation and corporate governanceand nominating committees;

·

•overseeingOverseeing the evaluation of the performance of the board and its committees on a continuing basis, including an annual self-evaluation of the performance of the corporate governance and nominating committee;

·

•consideringConsidering director nominees recommended by shareholders; and

Table of Contents·

•reviewingReviewing our overall corporate governance and reporting to the board on its findings and any recommendations.

Audit CommitteeAUDIT COMMITTEE

The members of the audit committee are Douglas K. Ammerman (Chair), Heather H. Murren and John D. Rood. The board has determined that each of the audit committee members is financially literate and independent as required by the rules of the Securities and Exchange Commission and the New York Stock Exchange, and that each of Mr. Ammerman, Ms. Murren and Mr. Rood is an audit committee financial expert, as defined by the rules of the Securities and Exchange Commission. The board of directors also reviewed Mr. Ammerman'sAmmerman’s service on the audit committee in light of his concurrent service on the audit committees of fourthree other public companies. The board of directors considered Mr. Ammerman'sAmmerman’s extensive financial and accounting background and expertise as a former partner of KPMG, his knowledge of our company and understanding of our financial statements as a long-timelong time director and audit committee member, and the fact that Mr. Ammerman is retired from active employment, and determined that Mr. Ammerman'sAmmerman’s service on the audit committees of four public companies, including FNF'sFNF’s audit committee, would not impair his ability to effectively serve on FNF'sFNF’s audit committee. The audit committee met nineseven times in 2017.2018.

The primary functions of the audit committee include:

appointing,·Appointing, compensating and overseeing our independent registered public accounting firm;

·

•overseeingOverseeing the integrity of our financial statements and our compliance with legal and regulatory requirements;

·

•discussingDiscussing the annual audited financial statements and unaudited quarterly financial statements with management and the independent registered public accounting firm; |

13 | Fidelity National Financial, Inc. |

|

|

·

•establishingEstablishing procedures for the receipt, retention and treatment of complaints (including anonymous complaints) we receive concerning accounting, internal accounting controls, auditing matters or potential violations of law;

·

•approvingApproving audit and non-audit services provided by our independent registered public accounting firm;

·

•discussingDiscussing earnings press releases and financial information provided to analysts and rating agencies;

·

•discussingDiscussing with management our policies and practices with respect to risk assessment and risk management;

·

•reviewingReviewing any material transaction between our chief financial officer or chief accounting officer that has been approved in accordance with our Code of Ethics for Senior Financial Officers, and providing prior written approval of any material transaction between us and our chief executive officer; and

·

•producingProducing an annual report for inclusion in our proxy statement, in accordance with applicable rules and regulations.

The audit committee is a separately-designated standing committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended.

Table of Contents

Report of the Audit CommitteeREPORT OF THE AUDIT COMMITTEE

The audit committee of the board of directors submits the following report on the performance of certain of its responsibilities for the year 2017:2018:

The primary function of our audit committee is oversight of (i) the quality and integrity of our financial statements and related disclosures, (ii) our compliance with legal and regulatory requirements, (iii) the independent registered public accounting firm'sfirm’s qualifications and independence, and (iv) the performance of our internal audit function and independent registered public accounting firm. Our audit committee acts under a written charter, and we review the adequacy of our charter at least annually. Our audit committee is comprised of the three directors named below, each of whom has been determined by the board of directors to be independent as defined by New York Stock Exchange independence standards. In addition, our board of directors has determined that each of Mr. Ammerman, Ms. Murren and Mr. Rood is an audit committee financial expert as defined by the rules of the Securities and Exchange Commission.

In performing our oversight function, we reviewed and discussed with management and Ernst & Young LLP, orEY,, our independent registered public accounting firm, our audited financial statements as of and for the year ended December 31, 2017.2018. Management and EY reported to us that our consolidated financial statements present fairly, in all material respects, the consolidated financial position and results of operations and cash flows of FNF and its subsidiaries in conformity with generally accepted accounting principles. We also discussed with EY matters covered by the Public Company Accounting Oversight Board Auditing Standards No. 16 (Communications With Audit Committees).

We have received and reviewed the written disclosures and the letter from EY required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant'saccountant’s communications with the audit committee concerning independence,

|

Fidelity National Financial, Inc. | 14 |

|

|

Table of Contents

and have discussed with them their independence. In addition, we have considered whether EY'sEY’s provision of non-audit services to us is compatible with their independence.

Finally, we discussed with our internal auditors and EY the overall scope and plans for their respective audits. We met with EY at each meeting. Management was present for some, but not all, of these discussions. These discussions included the results of their examinations, their evaluations of our internal controls and the overall quality of our financial reporting.

Based on the reviews and discussions referred to above, we recommended to our board of directors that the audited financial statements referred to above be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017,2018, and that EY be appointed independent registered public accounting firm for FNF for 2018.2019.

In carrying out our responsibilities, we look to management and the independent registered public accounting firm. Management is responsible for the preparation and fair presentation of our financial statements and for maintaining effective internal control. Management is also responsible for assessing and maintaining the effectiveness of internal control over the financial reporting process. The independent registered public accounting firm is responsible for auditing our annual financial statements and expressing an opinion as to whether the statements are fairly stated in conformity with generally accepted accounting principles. The independent registered public accounting firm performs its responsibilities in accordance with the standards of the Public Company Accounting Oversight Board. Our members are not professionally engaged in the practice of accounting or auditing, and are not experts under the Exchange Act in either of those fields or in auditor independence.

Table of Contents

The foregoing report is provided by the following independent directors, who constitute the committee:

AUDIT COMMITTEE

Douglas K. Ammerman (Chair)

Heather H. Murren

John D. Rood

Compensation Committee

COMPENSATION COMMITTEE

The members of the compensation committee are Richard N. Massey (Chair), Daniel D. Lane and Cary H. Thompson. Each of Messrs. Massey, Lane and Thompson was deemed to be independent by the board, as required by the New York Stock Exchange. The compensation committee met sixfour times during 2017.2018. Our compensation committee reviews its charter annually. The functions of the compensation committee include the following:

reviewing·Reviewing and approving corporate goals and objectives relevant to the Chief Executive Officer'sOfficer’s compensation, evaluating their performance in light of those goals and objectives, and setting the Chief Executive Officer'sOfficer’s compensation level based on this evaluation;

·

•settingSetting salaries and approving incentive compensation and equity awards, as well as compensation policies, for all other officers who are designated as Section 16 officers by our board; |

15 | Fidelity National Financial, Inc. |

|

|

·

•makingMaking recommendations to the board with respect to incentive-compensationincentive compensation programs and equity-based plans that are subject to board approval;

·

•approvingApproving any employment or severance agreements with our Section 16 officers;

·

•grantingGranting any awards under equity compensation plans and annual bonus plans to our Chief Executive Officer the Executive Chairman and theother Section 16 Officers;

·

•approvingApproving the compensation of our directors; and

·

•producingProducing an annual report on executive compensation for inclusion in our proxy statement, in accordance with applicable rules and regulations.

For more information regarding the responsibilities of the compensation committee, please refer to the section of this proxy statement entitled "Compensation“Compensation Discussion and Analysis and Executive and Director Compensation"Compensation” above.

Board Leadership Structure and Role in Risk OversightBOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

We have separated the positions of CEO and Chairman of the board of directors in recognition of the differences between the two roles. Richard N. Massey, one of our independent directors, serves as our Lead Director. The board considers it to be useful and appropriate to designate a Lead Director to coordinate the activities of the other non-employee directors and to perform such other duties and responsibilities as the board may determine. Our board has adopted a Charter of the Lead Independent Director that defines the responsibilities of the Lead Director, which include:

preside·Preside at meetings of the board of directors in the absence of, or upon the request of, the Chairman;

·

•reviewReview board meeting agendas and schedules in collaboration with the Chairman and recommend matters for the board to consider and information to be provided to the board;

·

•serveServe as a liaison and supplemental channel of communication between non-employee/non employee/independent directors and the Chairman without inhibiting directcommunications between the Chairman and other directors;

Table of Contents·

•serveServe as the principal liaison for consultation and communication between the non-employee/non employee/independent directors and shareholders;

·

•adviseAdvise the Chairman concerning the retention of advisors and consultants who report directly to the board; and

·

•beBe available to major shareholders for consultation and direct communication.

The board considers it to be useful and appropriate to designate a Lead Director to serve in a lead capacity to coordinate the activities of the other non-employee directors and to perform such other duties and responsibilities as the board may determine.

The board of directors administers its risk oversight function directly and through committees. The audit committee oversees FNF'sFNF’s financial reporting process, risk management program, legal and regulatory compliance, performance of the independent auditor, internal audit function, and financial and disclosure controls. Management identifies strategic risks of FNF and aligns the annual audit plan with the auditable risks. Management presents the identified risks and the audit plan to the audit committee for review and approval. Management also reports quarterly to the audit committee and the board of directors regarding claims. Theclaims, and the audit committee also receives quarterly reports on compliance matters.

|

Fidelity National Financial, Inc. | 16 |

|

|

Table of Contents

Our board has a strong focus on cyber-security. At each regular meeting of the audit committee, our Chief Risk Officer, Chief Compliance Officer, Chief Information Security Officer and Chief Internal Audit Officer provide reports relating to our cyber and data security practices, risk assessments, emerging issues and any security incidents. Our audit committee chairman reports on these discussions to our board of directors on a quarterly basis. In addition, Mr. Rood has attended third-party director education courses on cyber-security and privacy issues and trends.

The corporate governance and nominating committee considers the adequacy of FNF'sFNF’s governance structures and policies. The compensation committee reviews and approves FNF'sFNF’s compensation and other benefit plans, policies and programs and considers whether any of those plans, policies or programs creates risks that are likely to have a material adverse effect on FNF. Each committee provides reports on its activities to the full board of directors.

Contacting the BoardCONTACTING THE BOARD

Any shareholder or other interested person who desires to contact any member of the board or the non-management members of the board as a group may do so by writing to: Board of Directors, c/o Corporate Secretary, Fidelity National Financial, Inc., 601 Riverside Avenue, Jacksonville, FL 32204. Communications received are distributed by the Corporate Secretary to the appropriate member or members of the board.

CERTAIN INFORMATION ABOUT OUR DIRECTORS

Director Criteria, Qualifications and Experience and Process for Selecting Directors

FNF underwent significant change in 2017. On September 29, 2017, we completed

DIRECTOR CRITERIA, QUALIFICATIONS AND EXPERIENCE AND PROCESS FOR SELECTING DIRECTORS

Following the Spin-Off of Black Knight to ourSpin-Off and the Cannae Split-Off in 2017, FNF Group shareholders. On November 17, 2017, we completed the Split-Off of Cannae, which consisted of the businesses, assets and liabilities formerly attributed to our FNFV Group, including Ceridian Holding, LLC, American Blue Ribbon Holdings, LLC and T-System Holding LLC.

As a result of these transactions, FNF is now a more streamlined company with a pure focus within the title and real estate space. WeTitle insurance revenue is closely related to the level of real estate activity which includes sales, mortgage financing and mortgage refinancing. The levels of real estate activity are primarily affected by the average price of real estate sales, the availability of funds to finance purchases and mortgage interest rates. The Mortgage Bankers Association’s (“MBA”) Mortgage Finance Forecast as of March 21, 2019 predicts overall mortgage originations in 2019 and 2020 will remain relatively flat compared to the 2018 period. Originations are expected to be driven by a slight increase in originations from purchase transactions mostly offset by a slight decrease in originations from refinance transactions. In 2019, we expect to continue to focus on growing our business organically while carefully managing costs to address any changes in the mortgage market. Following closing of the Stewart Merger, we will also focus on integration of the Stewart businesses and through strategic acquisitions. As partachieving synergy targets to drive value for our shareholders. We believe the skills and experience of that strategy, on March 18, 2018, we announced that we had entered intoour board members are well suited to provide strong oversight and guidance as our management works to drive growth and manage costs and integrate Stewart following closing of the Merger Agreement with Stewart.Stewart Merger.

Our board and the corporate governance and nominating committee is committed to include the best available candidates for nomination to election to our board based on merit. Our board and our corporate governance and nominating committee continuously evaluates our board's board’s

|

17 | Fidelity National Financial, Inc. |

|

|

Table of Contents

composition with the goal of developing a board that meets our strategic goals, and one that includes diverse, experienced and highly qualified individuals.

Table of Contents

The corporate governance and nominating committee does not set specific, minimum qualifications that nominees must meet in order for the committee to recommend them to the board, but rather believes that each nominee should be evaluated based on his or her individual merits, taking into account our needs and the overall composition of the board. In accordance with our Corporate Governance Guidelines, the corporate governance and nominating committee considers, among other things, the following criteria in fulfilling its duty to recommend nominees for election as directors:

•personal·Personal qualities and characteristics, accomplishments and reputation in the business community;

·

•currentCurrent knowledge and contacts in the communities in which we do business and in our industry or other industries relevant to our business;

·

•abilityAbility and willingness to commit adequate time to the board and committee matters;

·

•theThe fit of the individual'sindividual’s skills and personality with those of other directors and potential directors in building a board that is effective, collegial and responsive to our needs; and

·

•diversityDiversity of viewpoints, background, experience, and other demographics, and all aspects of diversity in order to enable the Board to perform its duties and responsibilities effectively, including candidates with a diversity of age, gender, nationality, race, ethnicity, and sexual orientation.

Each year in connection with the nomination of candidates for election to the board, the corporate governance and nominating committee evaluates the background of each candidate, including candidates that may be submitted by shareholders.

We believe that the current composition of our board has served us well and that our current directors possess relevant experience, skills and qualifications that contributedcontribute to a well-functioning board that effectively oversees our long-term strategy. FNF has undergone significant change in recent years, and our board believes that it has been important to maintain consistency in our board to execute upon our long-term strategy, while selectively adding new board members who have important skill sets, experience or diversity of viewpoint. Our board believes our board, which is composed of directors who have a strong understanding of our business, operational and strategic goals, as well as our industry and the risks we face, has been crucial to our ability to effectively execute on our long-term strategy.

In connection with the 2018 annual meeting of shareholders, the

Our corporate governance and nominating committee undertook to examineregularly examines ways that it could foster the diversity of our board across many dimensions to maintain its ability to operate at a high-functioning level and to reflect the board'sboard’s commitment to inclusiveness. In connection with this examination, the committee revised our Corporate Governance Guidelines to expressly include diversity of age, gender, nationality, race, ethnicity, and sexual orientation as a part of the criteria the committee may consider when selecting nominees for election to the board, all in the context of the needs of our board at any given point in time. Specifically, the corporate governance and nominating committee is focused on considering highly qualified women and individuals from minority groups who may be recommended by our directors, management, or our shareholders as candidates for nomination as directors.

|

Fidelity National Financial, Inc. | 18 |

|

|

Proxy AccessTable of Contents

PROXY ACCESS

In February 2016, in response to our shareholders' support of a "proxy access" shareholder proposal at our 2015 annual shareholders meeting, our board of directorswe amended and restated our bylaws to implement a "proxy access"“proxy access” procedure for shareholder director nominations. Pursuant to Section 3.1 of our bylaws, a shareholder, or a group of up to 25 shareholders, may include in our proxy

Table of Contents

materials director nominees constituting up to two individuals or 20% of our board, whichever is greater, provided that:

•the·The nominating shareholder(s) own a number of shares representing 3% or more of the total voting power of the Company'sCompany’s outstanding shares of capital stock entitled to vote in the election of directors;

·

•theThe nominating shareholder(s) have owned that number of shares continuously for at least three years; and

·

•theThe nominating shareholder(s) and their director nominee(s) otherwise satisfy the applicable requirements of Section 3.1 of the amended and restated bylaws.

A shareholder who wishes to suggest a qualified candidate for director to the corporate governance and nominating committee but does not meet the requirements described above may do so by writing to our Corporate Secretary at 601 Riverside Avenue, Jacksonville, Florida 32204. The submission must provide the information required by, and otherwise comply with the procedures set forth in, Section 3.1 of our bylaws. Section 3.1 also requires that the nomination notice be submitted by a prescribed time in advance of the meeting. The corporate governance and nominating committee and the board apply the same criteria in evaluating candidates nominated by shareholders as in evaluating candidates recommended by other sources. Upon receipt of a shareholder-proposed director candidate that does not meet the "proxy access" requirements of our bylaws, the corporate secretary will assess the board's needs, primarily whether or not there is any current pending vacancy or a possible need to be filled by adding or replacing a director. The corporate secretary will also prepare a director profile by comparing the desired list of criteria with the candidate's qualifications. Submissions that meet the criteria outlined above and in our corporate governance guidelines will be forwarded to the Chairman of the corporate governance and nominating committee for further review and consideration. To date, no suggestions with respect to candidates for nomination have been received from shareholders.

Information About the Director Nominees and Continuing DirectorsSee “Shareholder Proposals” below.

INFORMATION ABOUT THE DIRECTOR NOMINEES AND CONTINUING DIRECTORS

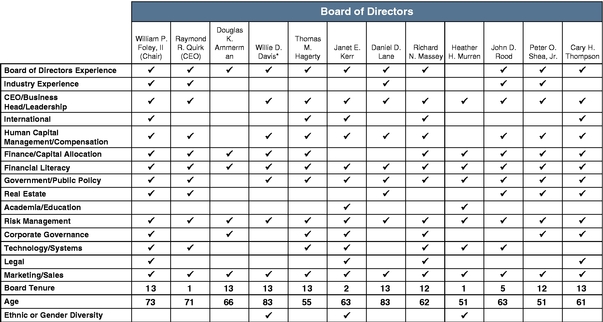

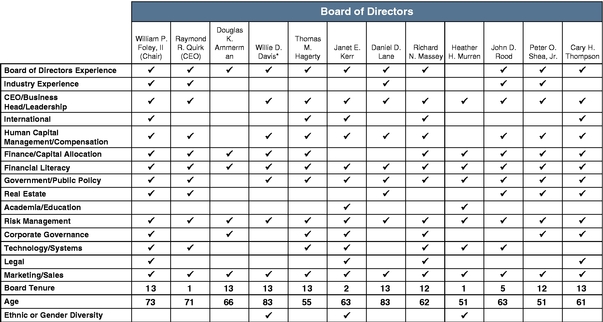

The matrix below lists the skills and experience that we consider most important for our directors in light of our current business and structure. In addition, biographical information concerning our nominees proposed for election at the annual meeting as Class III directors of the Company, as well as our continuing Class III and Class III directors, including each directors'director’s relevant experience, qualifications, skills and diversity, is included below.

Chart Continued ►

|

19 | Fidelity National Financial, Inc. |

|

|

Table of Contents

*

After discussion among Mr. Davis and the other directors, it was decided that Mr. Davis would not be nominated for re-election at the annual meeting. In order for the Board to continue to benefit from Mr. Davis' valuable insight and a diverse point of view, Mr. Davis has been appointed by the board to serveis serving as Director Emeritus for a three-year term beginning afterending at our 20182021 annual meeting of shareholders.shareholder meeting. As Director Emeritus, Mr. Davis will beis invited to attend and participate in boardBoard meetings, but willdoes not vote on board matters, and will receivematters. He receives an annual cash retainer of $40,000 and an annual equity retainer with a value of approximately $107,500, which are equal to1/ 1/2 of the cash and equity retainers received by our other directors, for his service.

Nominees for Class I Director—Term Expiring 2021 (if elected)

|

Nominee Class ll Directors—Term Expiring 2022 (if elected) |

|

|

|

Name | Position |

|

|

|

|

Richard N. Massey | Lead Director Chairman of the Compensation Committee Member of the Corporate Governance and Nominating Committee |

| |

| |

Daniel D. (Ron) Lane | Member of the Compensation Committee |

| |

| |

Cary H. Thompson | Member of the Compensation Committee |

| |

|

Fidelity National Financial, Inc. | 20 |

|

|

Table of Contents

Richard N. Massey. Mr. Massey has served as a director of the Company since 2006. Mr. Massey has been a partner of Westrock Capital, LLC, a private investment partnership, since January 2009. Mr. Massey was Chief Strategy Officer and General Counsel of Alltel Corporation from January 2006 to January 2009. From 2000 until 2006, Mr. Massey served as Managing Director of Stephens Inc., a private investment bank, during which time his financial advisory practice focused on software and information technology companies. Mr. Massey also serves as a director of Black Knight, Cannae and FGL Holdings. He is also a director of D&B, which is privately held, a director of the Oxford American Literary Project and Chairman of the Board of the Arkansas Razorback Foundation. Mr. Massey formerly served as a director of Fidelity National Information Services, Inc. (FIS) and Bear State Financial, Inc.

Mr. Massey’s qualifications to serve on the FNF board include his experience in corporate finance and investment banking and as a financial, strategic and legal advisor to public and private businesses, as well as his expertise in identifying, negotiating and consummating mergers and acquisitions.

Daniel D. (Ron) Lane. Mr. Lane has served as a director of the Company since 2005, and as a director of predecessors of FNF since 1989. Since February 1983, Mr. Lane has been a principal, Chairman and Chief Executive Officer of Lane/Kuhn Pacific, Inc., a corporation comprising several community development and home building partnerships, all of which are headquartered in Newport Beach, California. Mr. Lane served as a director of CKE Restaurants, Inc. from 1993 through 2010, and served as a director of FIS from February 2006 to July 2008, and as a director of LPS from July 2008 until March 2009. Mr. Lane is also a member of the Board of Trustees of the University of Southern California.

Mr. Lane’s qualifications to serve on the FNF board include his extensive experience in and knowledge of the real estate industry, particularly as Chairman and Chief Executive Officer of Lane/Kuhn Pacific, Inc., his deep knowledge of FNF and our business landscape as a long-time director, and his experience as a member of the boards of directors of other companies.

Cary H. Thompson. Mr. Thompson has served as a director of the Company since 2005, and as a director of predecessors of FNF since 1992. Mr. Thompson currently is Executive Vice Chairman of Global Corporate and Investment Banking, Bank of America Merrill Lynch, having joined that firm in May 2008. From 1999 to May 2008, Mr. Thompson was Senior Managing Director and Head of West Coast Investment Banking at Bear Stearns & Co., Inc. Mr. Thompson served as a director of FIS from February 2006 to July 2008, as a director of Lender Processing Services, Inc. from July 2008 to March 2009, and on the board of managers of Black Knight Fiancial Services, LLC from January 2014 until April 2015.

Mr. Thompson’s qualifications to serve on the FNF board include his experience in corporate finance and investment banking, his knowledge of financial markets, and his expertise in running a large and complex business organization and negotiating and consummating complicated financial transactions.

| | |

Name

| | Position with FNF |

|---|

21 | Fidelity National Financial, Inc. |

|

|

Table of Contents

|

Incumbent Class Ill Directors—Term Expiring 2020 |

|

|

|

Name | Position |

|

|

|

|

William P. Foley, II | Chairman of the Board |

| |

| |

Douglas K. Ammerman | Chairman of the Audit Committee |

| |

| |

Thomas M. Hagerty | Director |

| |

| |

Peter O. Shea, Jr | Chairman of the Corporate Governance and Nominating Committee |

| |